Freelancer Invoice Template - Free Download for Independent Contractors

Download free freelancer invoice templates for consulting, creative work, and professional services. Includes fields for hourly rates, project fees, and expenses. Available in Word, Excel, and PDF formats.

Professional freelancer invoices help you get paid on time and maintain clear records of your work. Our templates include fields for hourly rates, project fees, expenses, and payment terms.

Whether you're a freelance writer, designer, consultant, or developer, these templates have everything you need to bill clients professionally and track your income.

Managing Multiple Freelance Clients?

Save time with our invoicing software. Store client details, track projects, and get paid faster with automatic payment reminders and online payments.

What to Include on a Freelancer Invoice

Freelancer invoices need clear information to show what work you completed and when payment is due.

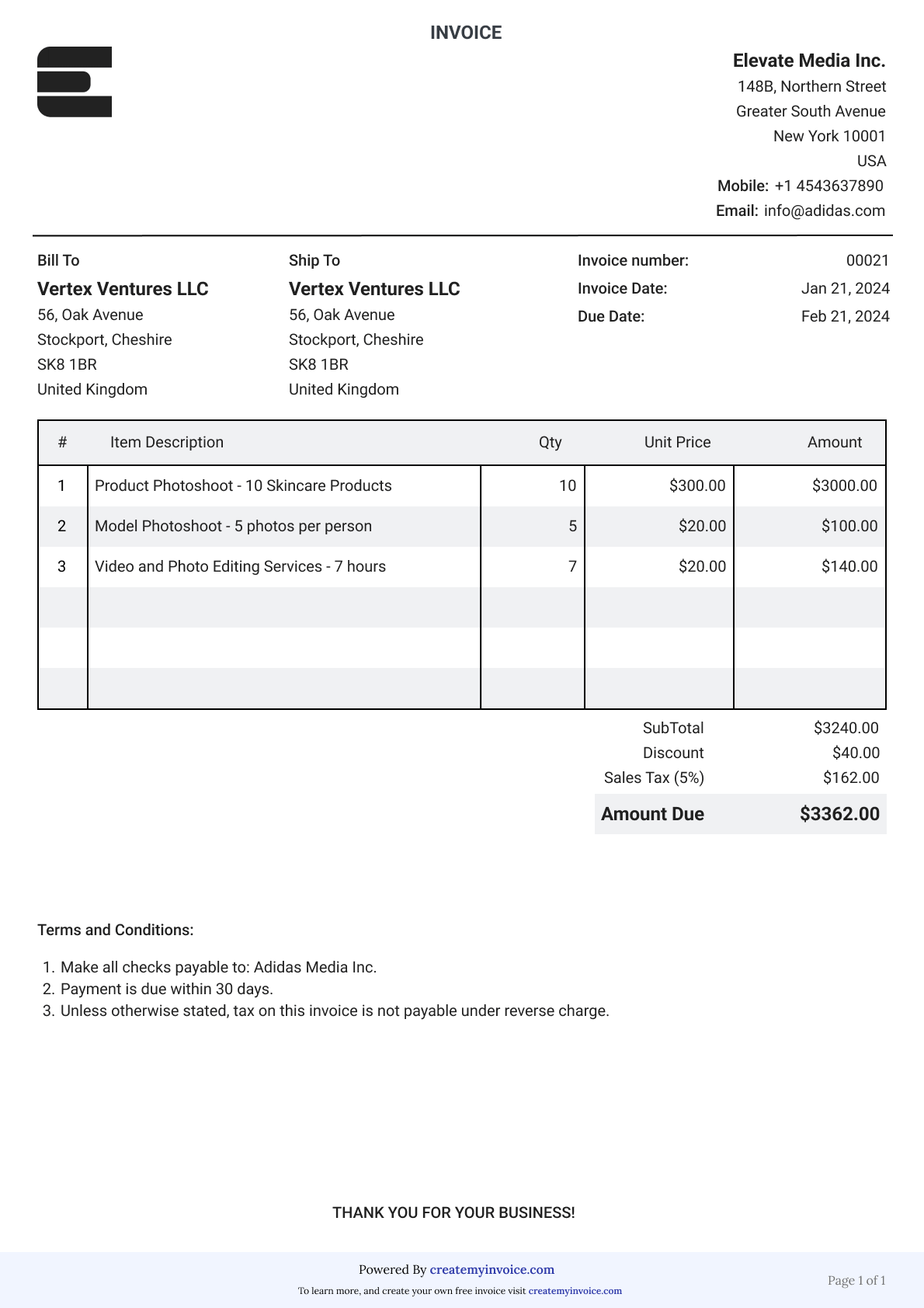

Your business information

Include your name or business name, address, phone, and email. If you have an LLC or business entity, use that legal name. Add your website if you have one. Some freelancers include their logo for a more professional look.

Client details

List client name, company name, billing address, and contact person. For larger companies, include the accounts payable email if you have it. This ensures your invoice reaches the right person.

Invoice numbering and dates

Use a clear invoice numbering system like "INV-001" or "2024-001." Include invoice date, project dates or billing period, and payment due date. Consistent numbering helps you track payments and makes bookkeeping easier at tax time.

Description of work

Be specific about what you delivered. Instead of "writing services," write "5 blog posts (800 words each) on digital marketing topics." Instead of "design work," write "logo design with 3 concepts and 2 revision rounds." Clear descriptions prevent payment disputes.

Hourly rate or project fee

Show your rate structure clearly. For hourly work, list hours worked per task or day, your hourly rate, and line totals. For project-based work, list deliverables with flat fees. Some freelancers combine both - a base project fee plus hourly rates for additional requests.

Expenses and reimbursements

List any expenses you paid on behalf of the client. Common freelancer expenses include stock photos, software subscriptions for the project, travel costs, or printing. Attach receipts if the client requires documentation.

Subtotal, taxes, and total

Add up your fees and expenses for the subtotal. Add any applicable taxes. Most freelancers don't charge sales tax on services, but rules vary by state and service type. Show the total amount due prominently.

Payment terms and methods

State when payment is due - Net 30 is standard for most freelance work, but you can use Net 15 or Due Upon Receipt. List accepted payment methods like bank transfer, PayPal, Venmo, or check. Include your payment details (PayPal email, Venmo handle, or bank info for ACH transfers).

Download Free Freelancer Invoice Template

Download our freelancer invoice template designed for consultants, creatives, and service providers. Includes all the fields you need for hourly or project-based billing.

Download in your preferred format:

What's included:

- Your business information section

- Client and project details

- Hourly rate or project fee options

- Expense tracking

- Subtotal, tax, and total calculations

- Payment terms and methods

- Professional design

- Easy to customize

Excel version includes automatic calculations for hours, rates, expenses, and totals.

Juggling multiple freelance projects? Our invoice generator lets you track hours automatically, save client payment details, send automated reminders.

Get started free →How to Fill Out Your Freelancer Invoice

Follow these steps to create professional freelancer invoices

Add your business details

Include your name or business name, address, phone, and email. If you operate as an LLC or sole proprietor, use your registered business name. Add your logo if you have one to make invoices more memorable.

Enter client and project information

Add client name, company, and billing address. Include invoice number (use consistent numbering), invoice date, and due date. Add a project name or reference number if the client uses one for tracking.

List your work and rates

For hourly work, break down hours by task or date with your hourly rate. For project work, list each deliverable with its fee. Be specific with descriptions so clients know exactly what they're paying for. Add any expenses with descriptions and amounts.

Set payment terms and totals

Calculate subtotal, add any taxes (check your state requirements), and show total due. Specify payment terms (Net 30, Net 15, Due Upon Receipt) and list accepted payment methods with details.

Freelancer Invoicing Tips

Invoice immediately after completing work

Send invoices as soon as you finish a project or at the end of your billing period for ongoing work. Faster invoicing means faster payment. Don't wait days or weeks to send invoices - clients may forget details or delay payment.

Be detailed with your work description

Vague descriptions lead to payment questions and delays. Instead of "consulting services," write "3 strategy sessions (2 hours each) on marketing automation implementation." Details show the value you provided and justify your rates.

Use consistent invoice numbering

Pick a numbering system and stick with it. Sequential numbers (INV-001, INV-002) or date-based (2024-001, 2024-002) both work well. Consistent numbering helps you track which invoices are paid and makes tax time easier.

Set clear payment terms upfront

Discuss payment terms before starting work. Net 30 is standard, but new clients sometimes use Net 60 or Net 90. If you need faster payment, negotiate Net 15 or require partial payment upfront for large projects.

Follow up on overdue invoices

Send a friendly reminder 3-5 days after an invoice is due. Many late payments are simply forgotten or lost in email. A polite follow-up often results in immediate payment.

Track your time as you work

Don't try to remember hours at the end of the week or month. Track time daily or use a time tracking tool. Accurate time tracking ensures you bill for all work and can justify hours to clients if questioned.

Stop Creating Invoices From Scratch

Use our invoicing software to save client details, track multiple projects, and send invoices in seconds. Accept online payments and get paid faster.

Frequently Asked Questions

Do your work however you want, we'll help you surface your impact so you can feel good about what you do.

Have additional questions? Contact us!

Contact UsWhat invoice numbering system should freelancers use?

Use sequential numbering (INV-001, INV-002) or date-based numbering (2024-001, 2024-002). The key is consistency. Sequential numbering is simplest. Date-based numbering helps you see invoice age at a glance. Avoid gaps in numbering as this can raise questions during audits.

Should I charge sales tax as a freelancer?

What payment terms should freelancers use?

How do I handle expenses on freelancer invoices?

Should I include a late payment fee?

What's the best way to send invoices to clients?