Photography Invoice Template - Free Download for Photographers

Download free photography invoice templates for weddings, events, portraits, and commercial shoots. Includes fields for session fees, prints, digital files, and licensing. Available in Word, Excel, and PDF formats.

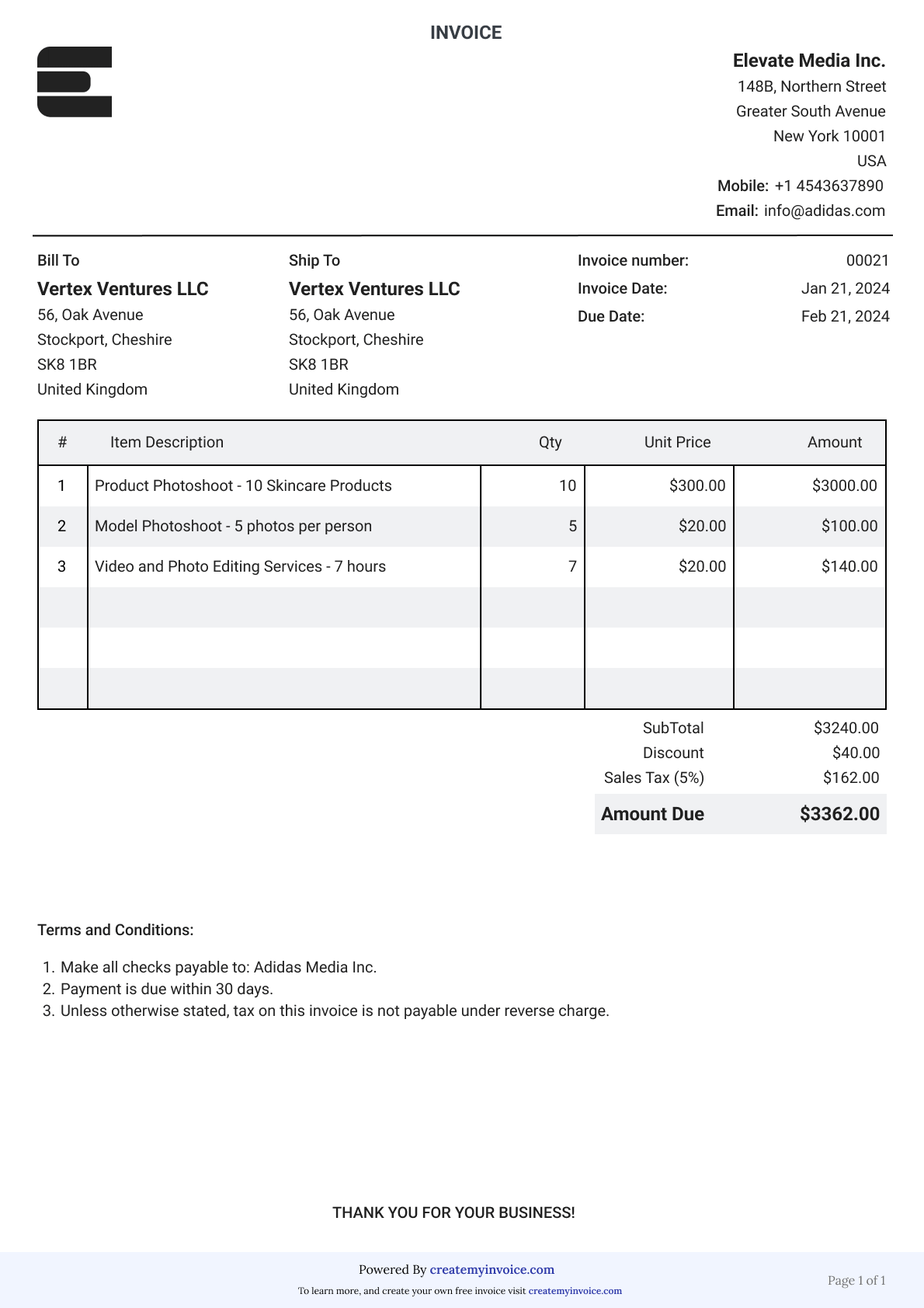

Professional photography invoices help you get paid promptly and clearly communicate your pricing structure. Our templates include fields for session fees, print packages, digital files, travel costs, and image licensing terms.

Whether you shoot weddings, family portraits, corporate events, or commercial photography, these templates have everything you need to bill clients professionally.

Shooting Multiple Sessions Weekly?

Save time with our invoicing software. Store client shoot details, track print orders, and manage payment schedules for wedding packages automatically.

What to Include on a Photography Invoice

Photography invoices need clear details about services, deliverables, and usage rights for images.

Photographer and client information

Include your photography business name or your name, address, phone, email, and website. Add your business registration if you operate as an LLC. List client name, event or session type, and contact information. For commercial work, include the company name and project contact person.

Session or event details

Include shoot date, location, and type of photography (wedding, portrait session, corporate event, product photography). Note session length and any specific requests. For weddings, include ceremony and reception locations. For commercial shoots, reference the project name or campaign.

Session fees and day rates

Show your session fee, hourly rate, or day rate clearly. Wedding photographers often charge packages by hours of coverage. Portrait photographers typically charge session fees. Commercial photographers usually bill day rates or half-day rates. Be specific about what the session fee includes.

Packages and deliverables

Detail what's included in the photography package. Specify number of edited digital images delivered, resolution/format, delivery timeline, and delivery method. Note if prints, albums, or canvases are included. For weddings, packages often include engagement session, full wedding day coverage, and edited images.

Print pricing and products

List prints, enlargements, canvases, albums, or other physical products with sizes and prices. Many photographers offer print packages or à la carte pricing. Include framing costs if applicable. Show quantities, sizes (8×10, 16×20, etc.), and finish options (matte, glossy, canvas).

Digital files and downloads

Specify digital file deliverables - number of images, resolution (high-res for print, web-sized), file format (JPEG, RAW), and delivery method (online gallery, USB drive, cloud download). Note whether files are edited/retouched or RAW files.

Licensing and usage rights

Clearly state image usage rights. For personal use (weddings, portraits), this is usually simple. For commercial photography, specify usage rights - web use only, print advertising, social media, duration of use, geographic restrictions, exclusivity. Commercial licensing often costs significantly more than personal use.

Travel and accommodation

Include travel costs for destination shoots. This might include mileage for local travel, airfare for destination weddings, hotel accommodations, meals, and rental car. Many photographers charge travel fees for shoots beyond a certain radius from their home base.

Additional services

List extra services like engagement sessions, trash-the-dress shoots, second photographers, videography, photo booth rental, rush editing, or additional editing/retouching beyond standard package. Show these as separate line items.

Deposits and payment schedule

Show deposit amount paid (typically 25-50% for weddings and events), remaining balance, and payment due dates. Many photographers require deposits to book dates, with balance due before or shortly after the shoot.

Download Free Landscaping Invoice Template

Download our landscaping invoice template designed for lawn care services, landscape installations, and grounds maintenance. Includes all the fields you need for labor, materials, and recurring services.

Download in your preferred format:

What's included:

- Your photography business information

- Client and session details

- Session fees and day rates

- Print and product pricing

- Digital file specifications

- Licensing and usage rights

- Travel and additional services

- Deposit and payment schedule

- Subtotal, tax, and total calculations

- Professional photography layout

Excel version includes automatic calculations for line items, materials, labor, and totals.

Managing weekly lawn care routes? Save time with invoicing software - create recurring invoices for regular customers, track seasonal contracts, see payment status by property.

Get started free →How to Fill Out Your Photography Invoice

Follow these steps to create professional photography invoices

Add your photography business details

Include your business name or personal name, address, phone, email, and website portfolio link. Add your business entity (LLC, sole proprietor) if applicable. Many photographers include their logo and tagline to strengthen their brand.

Enter client and shoot information

Add client name, contact details, and event or session type. Include invoice number (many photographers use 'CLIENT-SHOOT-001' or date-based formats), shoot date, location, and session type. For weddings, reference the wedding date and venue.

List packages and services

Detail your photography package - session fee, hours of coverage, number of edited images, prints included, and delivery timeline. Add any additional services like engagement sessions, albums, or extra editing. List prints or products with sizes and quantities.

Show licensing and payment terms

Specify image usage rights clearly, especially for commercial work. Note whether images are for personal use only or include commercial licensing. Include any restrictions on usage. Show deposit amount and due date, remaining balance, and payment method options.

Photography Invoicing Tips

Require deposits to book dates

Collect 25-50% deposits when booking shoots, especially for weddings and events. Deposits secure your calendar and show client commitment. Make deposits non-refundable to protect your business from last-minute cancellations.

Be crystal clear about deliverables

Specify exactly how many edited images clients receive, delivery timeline (typically 2-4 weeks for portraits, 6-8 weeks for weddings), resolution, format, and delivery method. Ambiguity leads to unrealistic expectations and disputes.

Separate print sales from session fees

Many photographers charge a session fee (covers your time and expertise) plus à la carte print pricing. This allows clients flexibility while ensuring you're compensated for your time regardless of product purchases.

Detail commercial licensing clearly

For commercial photography, be explicit about usage rights - unlimited vs limited use, duration, geographic restrictions, exclusivity. Commercial licensing should cost significantly more than personal use. Consider yearly licensing fees for ongoing commercial use.

Invoice before delivering finals

For non-wedding work, many photographers require full payment before delivering final edited images. This prevents payment issues after you've already done the work. For weddings, final payment is often due before or on the wedding day.

Track print orders separately

If clients order prints weeks or months after the session, create separate invoices for print orders. Reference the original session invoice number. This keeps accounting clean and helps track product orders versus session fees.

Stop Creating Photography Invoices From Scratch

Use our invoicing software to manage all photography clients, track payment schedules for weddings, create professional branded invoices, and accept online payments instantly.

Frequently Asked Questions

Do your work however you want, we'll help you surface your impact so you can feel good about what you do.

Have additional questions? Contact us!

Contact UsShould photographers charge sales tax?

Sales tax rules vary by state. Most states tax physical products (prints, albums, canvases) but not creative services (session fees, editing time). Digital downloads may or may not be taxable depending on your state. Check with your state's department of revenue or a tax professional.

What payment terms should photographers use?

How should I price commercial photography licensing?

Should I charge for travel to shoots?

How many edited images should I deliver?

What's the difference between session fees and print packages?

Should I include RAW files or only edited JPEGs?

How do I handle rush editing requests?